In the autumn of 2020, the Ministry of Agriculture made a decision that angered all agricultural producers without exception: it introduced a protective tariff on sunflower exports. At the same time, sunflower oil manufacturers signed an agreement for retail oil prices stabilization. And at the beginning of the new season, i.e., from 1 September 2021, a floating export duty on sunflower oil took effect.

Many renowned experts on various platforms predicted a decline in acreage and the exodus of farmers from the sunflower business. That no one in this country would be interested in it. That this was a gross violation of the laws of the market and a case of the government shooting itself in the foot. Much has been said and written, and often categorically and very emotionally.

The industry justified the protective tariff on sunflower and backed the decision on oil, no matter how painful it could be for us.

A full season of life under the new rules has ended, and we can see the early outcomes. The results of this year's season turned out to be very interesting: we are firmly on course to break all-time records for all oilseed crops.

New season records

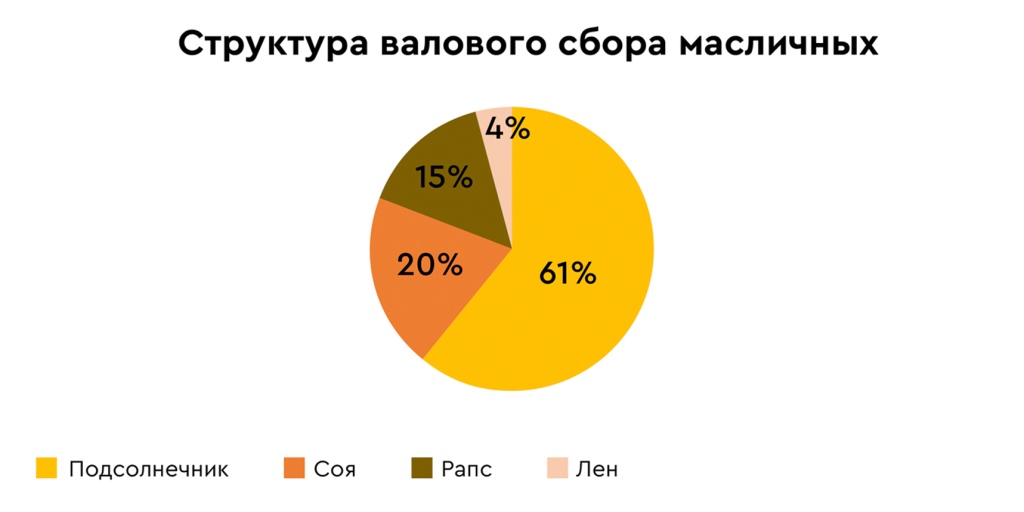

Last year, 15.5 million tons of sunflower were harvested; we expect 17 million tons this year. An all-time record. Yet, we are still waiting for the highest figures. Compared to 4.7 million tons in the 2021/2022 season, 5.5 million tons are expected for the new season. And for the first time, we are nearing full self-sufficiency in soybean meal. The records do not end here: rapeseed volumes will reach 4 million tons, which is 40% more than last year. Combined with linseed, this year's oilseed harvest is expected at 27 million tons!

What was the main driver behind such record levels? Government intervention, ultra-high incomes of crop producers who remained after the introduction of the tariffs, or the global environment? It's probably not that important. Let's just put it on record that when the experts make noise, saying everything is lost, they can be seriously mistaken.

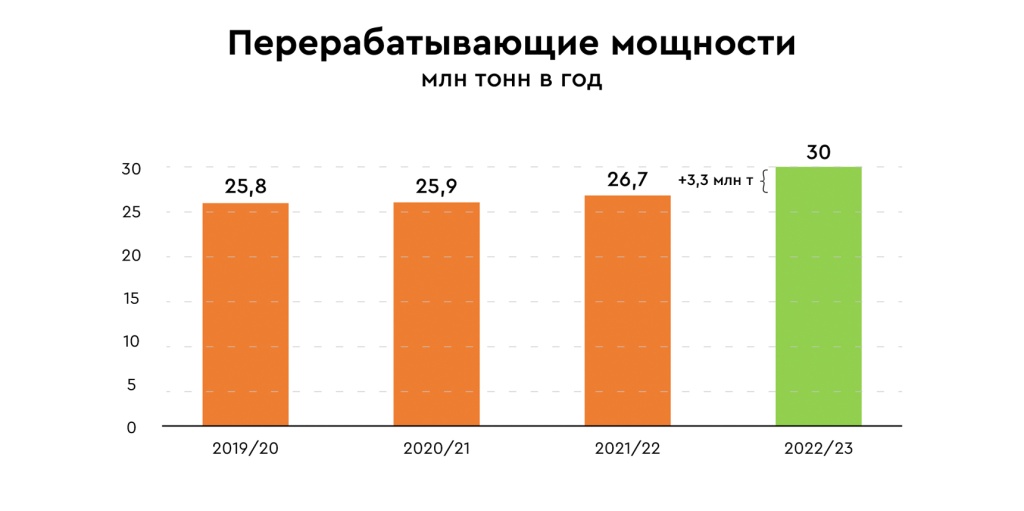

Do processors have the capacity for taking in such volumes? There is also a lot of good news for local farmers. Sodruzhestvo, Cherkizovo, Miratorg, and Orelrastmaslo completed their construction projects this year. Facilities with a capacity of 3.5 million tons have already been commissioned or will be commissioned soon. Local oil processing can now easily manage 30 million tons. That means some of the processors will not have enough raw materials. Therefore, major agricultural producers can rest assured that all their products will be bought and processed.

Construction of new facilities continues. And it's great that new crops are being introduced. Nobody believed soybeans could be grown in Chernozem soil ten years ago. Today, it is one of the main crops in the region. And next year, we will start exporting soybean or meal. Rapeseed is gaining momentum and has the potential to reach 5-6 million tons in the coming years. Linseed is also rising and has a good potential for processing. This crop is primarily exported, and processing has not been tried yet. Among oilseeds, linseed has the potential to be as big as soybean and rapeseed.

What prices to expect?

In our industry, any price forecasts are a thankless task. But you can try to weigh the factors that will certainly affect supply and demand and determine price highs and lows this season.

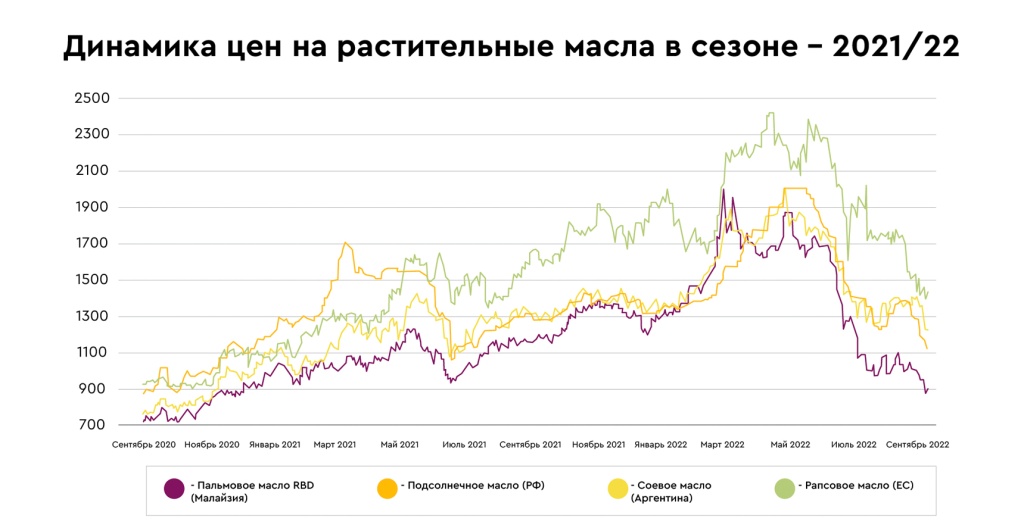

First, after a two-year peak in global markets, prices for all vegetable oils have apparently started dropping. What prompted this? Indonesia's strange ban on palm oil exports in May and stockpiled warehouses that are now clearing stocks, good harvests or something else? The fact remains that the market did not have time to get accustomed to the price of sunflower oil on the FOB Black Sea of about $2,000 per ton. Now, it is steadily returning to $1,000. Prices for all major vegetable oils plunged 50% by the beginning of the season.

Secondly, the record sunflower harvest puts pressure on the market. And the peak carry-over stocks from last season have not been very helpful in expecting high prices.

And thirdly, there is the record grain harvest, low prices on the back of a downward global trend and stockpiled warehouses. By the way, oil processors can come to the rescue. They only have to start selling what is left, especially since factories are without raw materials until the new harvest. And for the season - all have significant storage and processing capacities, which have been under-utilised in recent years. A good opportunity to help colleagues.

If the FOB Black Sea price for oil is around $1,000 - $1,200 per ton, as it is now, then sunflower will most likely trade at 25,000 to 30,000 ruble per ton (including VAT) this year. And if oil drops to $1,000 per ton, which is what most of the market players I spoke with are leaning towards, then sunflower will be trading at 22,000 to 26,000 rubles per ton (including VAT).

Another season, unlike previous ones, interesting and challenging for processors, awaits us.

Good harvesting weather for everyone.

Record harvests.

And guess the price.